One in three Americans say they would use digital wallets if mobile wallets were accepted at more locations, a new survey by JPMorgan Chase finds, and merchants appear ready to heed the call.

The survey, commissioned by the nation’s largest bank, found that only 16 percent of U.S. consumers have completed a transaction with a digital wallet. One reason for the low uptake appears to be a perceived security risk: Almost half (46 percent) of those who have not used digital wallets cited security concerns as their reason for abstaining.

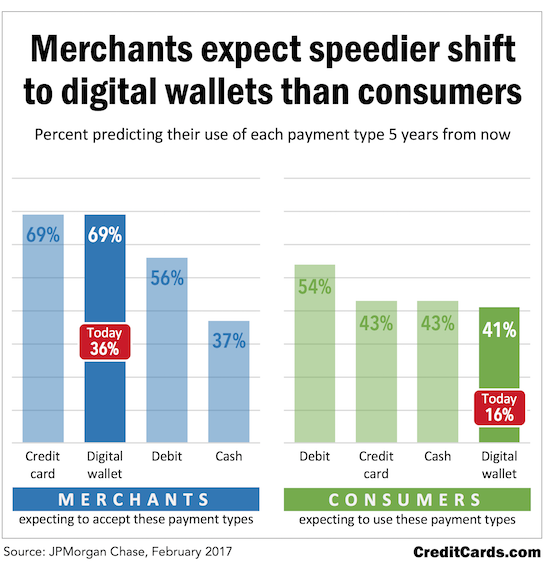

But another reason exists on the merchant side of the equation. With only 36 percent of merchants currently accepting digital wallets, consumers feel the technology isn’t widely enough available yet to rely on it as their primary payment method.

According to Chase’s findings, that could change substantially over the next several years. When merchant respondents were asked whether they anticipate accepting various payment types five years from now, digital wallet acceptance surged to the top, matched only by credit cards. Close to 70 percent of merchants expect to accept digital wallets in five years, which would almost double today’s rate.

Still, it seems merchants may have to wait for consumers to catch up. While consumer respondents also predicted a strong rise in their use of digital wallets in five years – up to 41 percent versus today’s 16 percent – their anticipated preferences still favor debit cards, credit cards and cash ahead of digital wallets.

Conducted in the fall of 2016, Chase’s survey was administered by Forrester Consulting and included 1,500 U.S. consumers age 18 or older who go online at least weekly, and over 800 merchants across a variety of industries. The survey results were released Feb. 28.