Among both brick-and-mortar and online businesses, security plays an important role in selecting payment solutions. The rise in data breaches and the desire to avoid associated risks is driving these security concerns. But their goals aren’t just to protect their businesses. They also want to provide a higher level of service to their customers.

Online shopping is fine, but is it secure?

What attributes are most important in an online payment solution?

No matter the type of business, many factors – capacity, speed, reliability – must be considered when choosing a payment solution. But as consumers move to card-not present environments, fraudsters are going with them – intent on exploiting every opportunity to cash in on stolen cardholder data. It’s no surprise that 60% of Converge customers said that security is the most important attribute in selecting an online payment solution. These business owners clearly understand their responsibility to provide a reliable customer experience. When asked why security is so important, open-ended responses included:

- “To be able to process payments securely and keep customers’ accounts, credit cards and bank accounts safe.”

- “Safely and securely accept my online payments and protect my customers’ information.”

- “Be secure, reliable, precise, user friendly and customer friendly.”

Safeguarding cardholder data for the benefit of customers isn’t the only concern, however. Business owners realize the practice benefits them too – whether they have an online presence or not. Similar to their online

counterparts, storefront businesses said they want to verify that credit cards are valid, as well as to securely and accurately process manual transactions

Implications: Converge customers are not alone in their longing for security. In a recent survey, “74% of merchants and retailers said that “they are worried about liability in the event of data breaches.” The question is no longer IF an attempt to steal data will occur, but WHEN.

Consumers want to know that they can shop with confidence. Furthermore, current regulations and certain state laws place more responsibility for protecting cardholder data on businesses. Failure to meet industry

and regulatory data security standards can be costly, with resulting loss of reputation and income

It is imperative that businesses proactively respond to threats with effective tools and solutions – including payment processing – that not only support, but also protect their operational and revenue goals.

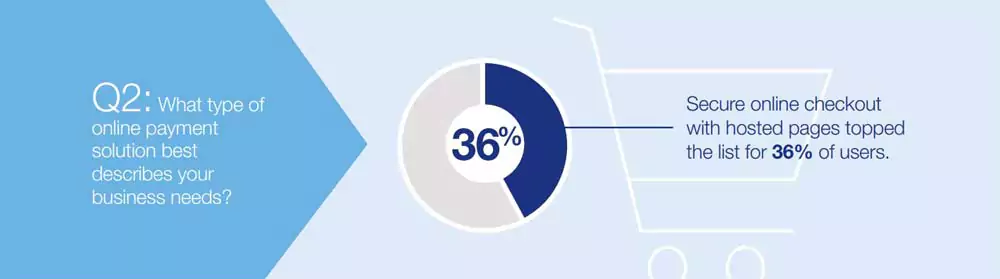

Businesses want to serve up a secure shopping experience via hosted pages

What type of online payment solution best describes your business needs?

The desire for security influenced Converge customers’ choice of payment solution type. They are keenly interested in technologies that help to protect card data. Secure online checkout with hosted pages topped the

list for 36% of users. This feature came in higher than both integrated payments pages (24%) and the ability to offer a complete online store (18%). “Other” solution needs reported via open-ended responses included:

- Flexibility to accept payments from anywhere.

- Mobile payment acceptance.

- The ability to accept multiple types of payments – cash, ACH, cards, etc.

Implications: Hosted payment pages enable merchants to present a seamless, yet secure shopping experience. They can also reduce IT requirements and costs. There are several ways to integrate these pages with the business’s site.

One option is for the payments provider to capture data directly on the site using a template with the business’s look and feel, but process and manage it behind the scenes. Redirects to the processor’s site, where the

cardholder enters payment information, after which they are directed back to the business’s site are perhaps more common. Businesses may also opt for hosted tokenization where the payment data is captured on their site, but still transmitted, stored and processed by their payments provider.

Hosted pages are a great way for businesses to enhance card data security for their online customers, while limiting their own liability associated with managing customer cardholder data.

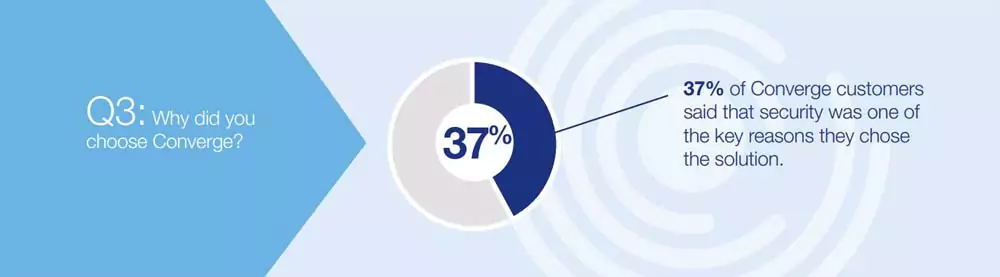

A trustworthy solution makes for trusting customers

Why did you choose Converge?

Thirty-seven percent of Converge customers said that security was one of the key reasons they chose the solution. The response was second only to “association with a financial institution,” (39%) and it applies to both online and storefront businesses. This suggests that businesses look to partner with payment processors who have significant experience in handling security issues – critical as threats become more sophisticated.

Open-ended responses from Converge customers clearly indicated that they understand the far-reaching impact of potential data breaches:

- “Because we are talking about other people’s money.”

- “Security threats happen at any time.”

- “Security is the number one priority and makes for a trusting customer.”

Overall, Converge customers said they are confident that the solution “eliminates risk for my company by offering protection with its security features.”

Implications: When it comes to security, businesses want to do the right thing by their customers. They expect that same level of commitment from their own service providers. By necessity, payment processing requires a holistic approach. It’s not enough to know where and how many transactions a business processes, but providers must also keep abreast of potential threats to business continuity, and be able to navigate an increasingly complex regulatory environment. They can then consult with clients on the right solution for their needs, how best to protect themselves, and how to ensure that they meet cardholder data security standards.

Converge enables businesses to securely accept payments in multiple environments, including in-store, mobile, mail/telephone order (MO/TO) and e-commerce. It keeps data safe throughout the payment process,

minimizes stored data liability, reduces certain compliance efforts and helps merchants limit account access to keep unauthorized users out.