Blog

We offer solutions for any business challenge.Mobile Payments Take a Click, but Processing Takes Days

If Google’s search engine started keeping bankers hours, people might take to the streets with pitchforks and torches. But a digital payment that takes over 72 hours to clear because you placed it on a Friday night? In the U.S., that’s the status quo. At Bank of...

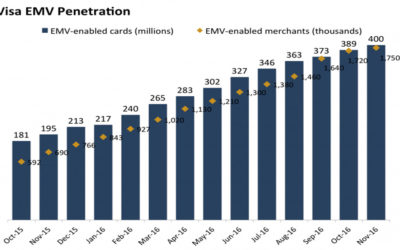

Here’s why US EMV could be poised to rise in 2017

This story was delivered to BI Intelligence "Payments Briefing" subscribers. In its monthly EMV update, Visa announced that chip-enabled merchants now account for 46% of the company’s in-store payment volume. The firm also saw over 800 million chip-on-chip...

Digital Wallets: Merchants to Pave The Way For Consumer Acceptance

One in three Americans say they would use digital wallets if mobile wallets were accepted at more locations, a new survey by JPMorgan Chase finds, and merchants appear ready to heed the call. The survey, commissioned by the nation's largest bank, found that only 16...

MasterCard Wants to Turn Your Thumbprint Into a PIN Number

MasterCard announced a “next generation biometric card” which embeds fingerprint recognition into debit cards. That may not be good news. The card requires customers to place their thumb on an embedded chip while it’s placed in card readers. Customers will still have...

8 tips for merchants to avoid credit card chargebacks

Chargebacks are a costly and unfortunate fact of life for many small businesses that accept credit cards. However, there are ways you can protect yourself against unfair chargebacks. Credit card chargebacks happen when customers contact their credit card issuers to...

Despite costs, airlines deploy mobile payments to leverage revenue opportunities

A new CellPoint Mobile-commissioned survey of more than 50 airline revenue and payments professionals finds common agreement around revenue opportunities that arise from deploying mobile payment capabilities, even as they cite common challenges for turning payment...

Mobile Payment: Advantages for Small Businesses

Mobile payment is a trend that is quickly catching up with customers. The advanced mobile currently in existence enable users not only to browse the Internet and communicate with their social network contacts while on the go, but also to make purchases and make...

Upgrading to EMV Reduces Fraud Liability and Boosts Customer Experience

Many small businesses operate on tight margins. That’s one reason they have been slow to upgrade their payment systems to accept EMV chip-enabled cards. Many are also stymied by the cost and complexity of the required changes. October 2015 marked the deadline for...

American Express Study Finds Mobile Changing Restaurants

If you ever thought that mobile payments, mobile ordering, and other such mobile technologies were having some kind of impact on the restaurant business, but you weren’t sure just what kind of impact, take a moment to congratulate yourself on such highly-toned...

Importance of Chargeback Prevention

How Chargeback Reports Help Reduce Risk and Retain Revenue Chargeback management often seems like more of an art than a science. There are so many variables that are subjective and open to interpretation. However, if merchants use the right tools, chargeback...